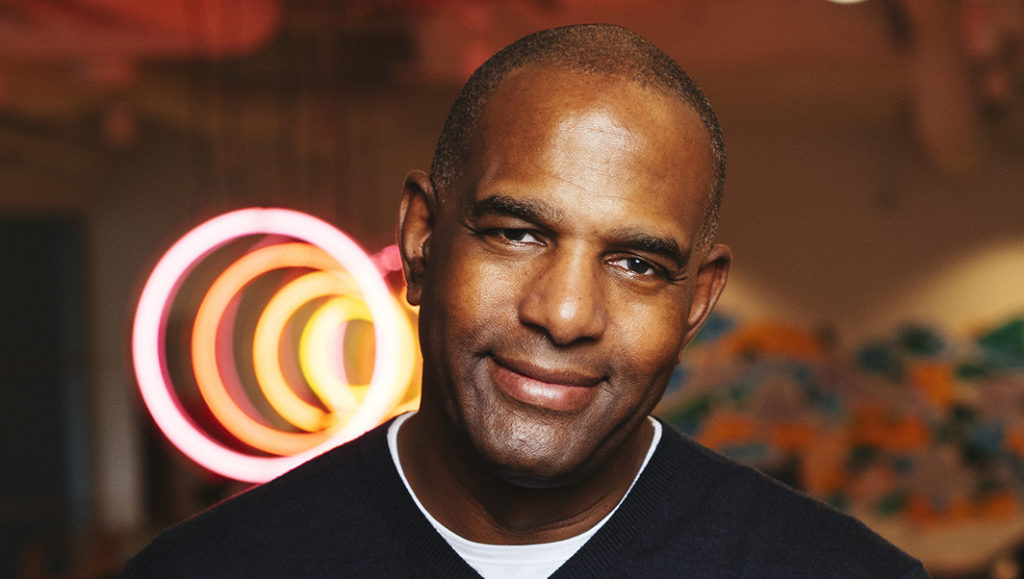

Exclusive Interview: Pop Culturalist Chats with Rory Douglas

Rory Douglas is no stranger to success. From his early days as an intern in the music industry to becoming one of the top financial educators today, Rory excels in anything he sets his mind to. But that doesn’t mean he hasn’t faced challenges along the way! Pop Culturalist caught up with Rory for a candid conversation about his career, his latest projects, and why success is always found in a pile of mistakes.

PC: You started your career off as a manager in the music industry. Can you walk us through your journey from management to becoming a financial educator?

Rory: Actually, I originally started my music career off as an intern! A colleague of mine who was in the music business thought I would do a good job because of my personality and attitude.

I basically watched from afar and watched exactly what he was doing. I started the internship and saw insights into the music industry. I, then, proceeded to go back to work at my normal job.

An opportunity came up where I had to make a decision: my good friend and colleague was like, “We’re going on tour. Why don’t you come on tour? We can pay you, but not very much.” So, I decided to go to my boss. I asked my boss, “I want to go on this tour. Could I take a month and a half off?” My boss was like, “No, you can’t take a month and a half off.” I had to make a decision.

I actually chose to go out on this tour pretty much as an intern. I was getting coffee and doing all different things, like picking up the artists from the airport and so on. When I went on tour, I had a chance to really, really see a lot of different things. They pretty much gave me a name when I was on tour. It was “the man that gets it done.” So whatever people asked me, I would get it done.

Additionally, during the transition of the tour, I met a lot of really known artists, however, one of the artists that I met when I was on tour was an up-and-coming artist that wasn’t established yet that was singing background for certain groups. I pretty much became friends with that individual.

After we came off of the tour, I was given a job from the music company. They offered me an actual position in A&R. I took that and I decided from what I saw on that tour, I could actually do it myself, too. I also met a colleague that was a background singer for a very, very known singer who was aspiring to also be a singer and came to me and said, “Hey, you know. I really liked the way you worked on tour. Can you help me? I’m planning on starting my own career.”

I jumped in there. Then, that turned out to be a smash, and it took off from there. I’ve worked with artists like Bobby Brown in the very beginning of his career and a lot of other known artists. I actually worked with pop artists, R&B artists, gospel artists, and got a chance to do a couple of country ventures.

So, that’s how it all started. It started basically from being an intern and moving up the ladder from there. To make a long story short, that’s when I got into the music business. Thankfully, I had a lot of success.

Then, I met a friend who was a lawyer, Joseph Gellman. God bless his soul. He’s not here anymore, but Joseph Gellman was an entertainment attorney that was handling paperwork for us when it came down to our artists. One day Joseph told me, “You got something. You have what it takes. Why don’t you go ahead and start your own management company?” I told Joe, “Listen. I don’t know two things about starting my own management company.” He said, “Hey, you know what? I’ll set it up for you. Why don’t we be partners and start it?”

So, that’s when my music management company was born. It was called RKD Music Management, and we did some tremendous things. Joseph became really ill and he had to step aside. That was at the time when CDs were pretty much the masterpiece. CDs were in your stores like Targets, Walmarts, and Best Buys; they were pretty much the going thing.

Then, there was a transition between CDs and downloads. When downloads came in, it killed the CD business. That’s when I lost a lot of revenue. It pretty much turned into a big disaster financially. I ultimately had to sell my music management company to Universal Music Group. I actually sold it because I had a pretty good catalog and came out with some very, very good revenue, although I didn’t want to sell the company deep down inside. I was pretty much broken.

I learned during that transition that if I’m going to be in business, I needed to know business. I pretty much said to myself, “I need to know everything I can know about business.” I checked into school and took some classes on business. I started to read financial books. Then, I found out by reading those financial books and doing what I was doing that I found my passion. I really loved learning about finance and how money works—the whole nine yards.

I said to myself that I would never allow myself to get put in a crunch like that again. I turned into this financial guru. I love the financial industry. So, I transitioned from music to the financial industry by going to work for an agency first.

The agencies that I worked for, I would pretty much catapult to the top. I went from one agency to the next, and the same scenario came back around. I noticed that I had that entrepreneurial spirit in myself from the beginning. I never forgot what Joseph Gellman told me: “It’s so important that you run your own ship because whoever controls your money controls you.” That always stuck in the back of my brain.

I decided to start my own financial company called Aqua Financial. It’s really a success. I’m doing extremely well. I’m happy at this point in my life, but I learned from my mistakes. I went through some heartaches and pains, but I always tell people in life that there’s never losses; there are only lessons. I learned from my lessons.

PC: You’re an author, motivational speaker, podcaster, and financial educator. Is it ever a challenge to manage all the different facets to your career?

Rory: It’s not a challenge at all. I actually think that what I do I would actually do for free simply because I love it. I consider myself a change agent, which means although I’m a financial educator, which I know is extremely important in the world and America as a whole, when it comes down to uplifting, motivating, and helping people, that’s my passion and my purpose.

I’m living my purpose through my passion. It’s pretty much something I would do for free. It’s never a challenge, but there are a lot of things that are challenging. As an entrepreneur, though, I love that sense of challenge; it actually keeps me going. It keeps me getting up early in the morning and keeps me young, healthy, and vibrant running towards my goal and my dream.

PC: As a motivational speaker, you talk to a variety of different audiences. How do you cater your message to each? What’s the common piece of advice you share with them all?

Rory: I always make it a point to speak from my heart, which means I’m never scripted—that’s the only thing that connects. In today’s society, people don’t buy books, they don’t buy music, they buy you. If you cannot show your true self, your heart, there will be a disconnect. That’s one thing I learned early on: always speak from your heart. It’ll connect. That’s pretty much been my key to success, growing, and developing. The bottom line is to show your heart and don’t be afraid to make a mistake.

I think that people in life are so safe. We safeguard with everything we do. We watch what we say. We watch what we do. But, the bottom line is if your heart is pure and your intentions are right, you just have to speak from the heart and trust the process.

PC: You also recently collaborated with some fellow entrepreneurs to write a book, Cracking the Rich Code. Can you tell us about that collaboration and how that came to fruition?

Rory: Yes! Thank you for asking that question. I’m so excited about it. By being out in the marketplace and speaking to crowds, someone who heard me speak at an event came up to me. He said, “Hey, I’m actually a family member of a known motivational speaker. You really touched on my life with the things that you said. I would love for you to meet my family member, my mentor.” That person was Jim Britt, who is one of the top motivational speakers. He’s been around a long time.

So, I met with Jim Britt. I had a great conversation with him and told him exactly what my goal was and that my plan was to be a top motivational speaker in the next three years in America. He said, “You know what? I really like you, kid. I want you to be a part of a project that I’m about to put out. It’s called Crack the Rich Code.” It’s with Jim Britt, Kevin Harrington from Shark Tank, and Tony Robinson. I got to collaborate with those guys and put the book out, and it’s currently an international bestseller.

I’m excited about that project; it’s basically an entrepreneur’s blueprint for success. It gives you the basic principles of how to crack the rich code—not necessarily how to get rich, but how to crack the rich code, which means understanding the financial language and knowing what the rich know. You don’t have to be wealthy to know this information, but once you learn it, you’ll have money for a lifetime and not a lunchtime.

PC: You’re also the host of Holla at a Scholar. What can fans expect when they tune into your podcast?

Rory: My podcast is pretty much a laboratory rat where you’re basically just testing things. This podcast is a podcast where I can just be myself because I’m not one-dimensional. I can actually talk about so many different things. A lot of people are just one-dimensional in their delivery, but I can talk about inspiration, motivation, finance, and entertainment. It’s pretty much like a collage of gumbo that I put together. I just go out there and have a lot of fun. I talk about different topics each week.

PC: Given all the success that you’ve had, if you could tell your younger self one piece of advice, what would it be and why?

Rory: Wow, that’s a great question. The first thing is success is always found in a pile of mistakes—that’s what I would say. Success is always found in the pile of mistakes, and most people miss being successful because they’re afraid to make a mistake. That’s the reason why I lean on “Don’t be afraid to make a mistake.” You don’t get bitter, you get better.

The last thing is that we have a wrong interpretation of confidence. Everybody strives to have confidence, but confidence isn’t going to happen tomorrow. Confidence comes by doing the same thing over and over again. You get better at it. It’s all about just not being afraid to make a mistake and always keeping in mind that success is always found in a pile of mistakes.

To keep up with Rory, follow him on Instagram.

Photo Credit: Birdie Thompson

Discussion about this post